Payment receipts are essential for sellers to maintain accurate financial records, track historical data, and claim tax-deductible expenses on IRS tax returns. Buyers can also use payment receipts for financial records and tax-deductible expenses.

Payment receipts are essential for sellers to maintain accurate financial records, track historical data, and claim tax-deductible expenses on IRS tax returns. Buyers can also use payment receipts for financial records and tax-deductible expenses.

Table of Contents

- Types (26)

- What Information Does a Payment Receipt Include?

- When to Use a Payment Receipt

- Receipts and the IRS

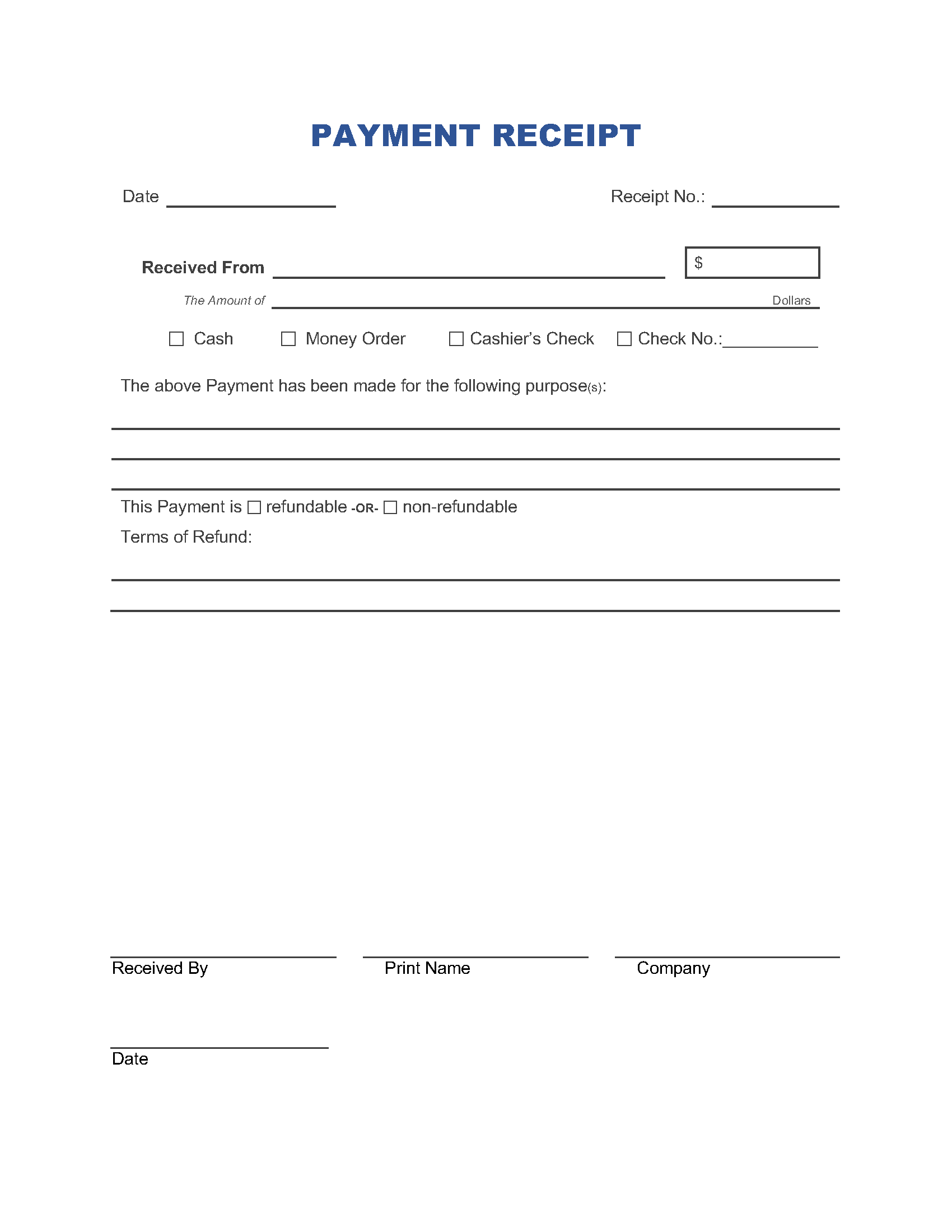

What Information Does a Payment Receipt Include?

A payment receipt can include any of the following information, depending on the nature of the transaction and the parties involved.

- Associated invoice number;

- Description of the goods or services exchanged for the payment;

- Discount deductions;

- Payer information (name, address, phone, email);

- Payment method:

- ACH transfer (account information),

- Cash,

- Check (check number),

- Credit card (card number, expiration date, and security code),

- Wire transfer (account information),

- Venmo transfer (account name),

- Zelle transfer (email or phone number).

- Receipt or tracking number;

- Recipient information (name, address, phone, email);

- Shipping fees;

- Signatures of both parties;

- Summary of charges:

- Cost of the good(s) or service(s) per unit/hour, etc.,

- Cost of add-ons,

- Quantities of items and add-ons,

- Subtotal,

- Tax rate,

- Total taxes due,

- Total amount due,

- Amount paid, and

- Outstanding balance; and

- Transaction date.

Itemized vs. Non-Itemized Receipts

A basic payment receipt states what was purchased, how it was purchased, and when it was purchased. An itemized payment receipt also lists a detailed breakdown of all items or services purchased, their associated quantities and costs, and any additional taxes or fees.

Receipt vs. Bill of Sale

While a receipt confirms that a payment was made towards a purchase, it doesn’t serve as legal proof of ownership or transfer of ownership. Receipts involving multi-item purchases also don’t necessarily have to be itemized. A bill of sale is always itemized and can act as legal proof of transfer of ownership from the seller to the buyer.

When to Use a Payment Receipt

Businesses and private individuals should issue a purchase receipt to any buyer of their goods or services. Receipts can be physically printed and delivered to the buyer, sent electronically to the buyer’s email address, or sent by SMS message to the buyer’s mobile phone.

Receipts and the IRS

Receipts support a business’s financial records, officially categorized as “Supporting Documents” by the IRS. Companies and individuals must submit receipts for any expenses on which they want to claim a tax deduction. The IRS suggests keeping receipts for at least (3) years, but if a business claims a loss in a given tax year, it should save those receipts for at least seven (7) years. Examples of supporting documents classified as receipts are:

- Cash register tapes;

- Copies of checks;

- Credit card receipts;

- Forms 1099-MISC; and

- Receipt books.

Table: Sales Tax Rates (By State)

Note: Some cities or counties within these states may have additional sales taxes that could bring the effective rate higher. COLUMNS: STATE – SALES TAX RATE

- Alabama – 4%

- Alaska – No statewide sales tax

- Arizona – 5.6%

- Arkansas – 6.5%

- California – 7.25%

- Colorado – 2.9%

- Connecticut – 6.35%

- Delaware – No statewide sales tax

- Florida – 6%

- Georgia – 4%

- Hawaii – 4%

- Idaho – 6%

- Illinois – 6.25%

- Indiana – 7%

- Iowa – 6%

- Kansas – 6.5%

- Kentucky – 6%

- Louisiana – 4.45%

- Maine – 5.5%

- Maryland – 6%

- Massachusetts – 6.25%

- Michigan – 6%

- Minnesota – 6.875%

- Mississippi – 7%

- Missouri – 4.225%

- Montana – No statewide sales tax

- Nebraska – 5.5%

- Nevada – 6.85%

- New Hampshire – No statewide sales tax

- New Jersey – 6.625%

- New Mexico – 5.125%

- New York – 4%

- North Carolina – 4.75%

- North Dakota – 5%

- Ohio – 5.75%

- Oklahoma – 4.5%

- Oregon – No sales tax

- Pennsylvania – 6%

- Rhode Island – 7%

- South Carolina – 6%

- South Dakota – 4.5%

- Tennessee – 7%

- Texas – 6.25%

- Utah – 6.1%

- Vermont – 6%

- Virginia – 5.3%

- Washington – 6.5%

- Washington, D.C. – 6%

- West Virginia – 6%

- Wisconsin – 5%

- Wyoming – 4%