Service Receipt Template

A service receipt is a written document acknowledging the receipt of a payment from one party to another. Instead of recording goods sold like a standard sales receipt, it records services rendered by the “seller” to or for the “buyer.” Contracted businesses and freelance service providers will most likely use this type of receipt. It’s important to note that a service receipt differs from a service invoice. The invoice asks for payment, while the receipt confirms payment was made and includes specific details about the transaction.

A service receipt is a written document acknowledging the receipt of a payment from one party to another. Instead of recording goods sold like a standard sales receipt, it records services rendered by the “seller” to or for the “buyer.” Contracted businesses and freelance service providers will most likely use this type of receipt. It’s important to note that a service receipt differs from a service invoice. The invoice asks for payment, while the receipt confirms payment was made and includes specific details about the transaction.

Table of Contents

- Types (28)

- Why is a Service Receipt Important?

- How to Create a Service Receipt

- What to Include in a Service Receipt

- Table: Are Services Taxable? (By State)

Why is a Service Receipt Important?

Service receipts are the most efficient tool for service providers to use as proof of payment for services rendered. It finalizes a transaction with a customer. Both buyers and sellers can use these receipts to maintain accurate financial records.

Is it Necessary to Keep Receipts?

Buyers aren’t required to keep receipts for legal purposes, but businesses should always keep service receipts, at least for a certain period. Business owners can, for example, use service receipts to prove business-related expenses for tax purposes. Employees can use service receipts to obtain expense reimbursements from their employers. Service receipts are also incredibly valuable for both parties if a dispute about services rendered or payment received ever arises.

How Long to Keep Receipts

The IRS suggests keeping receipts for a minimum of three (3) years, or seven (7) years if a business claimed a loss for a particular tax year.

How to Create a Service Receipt

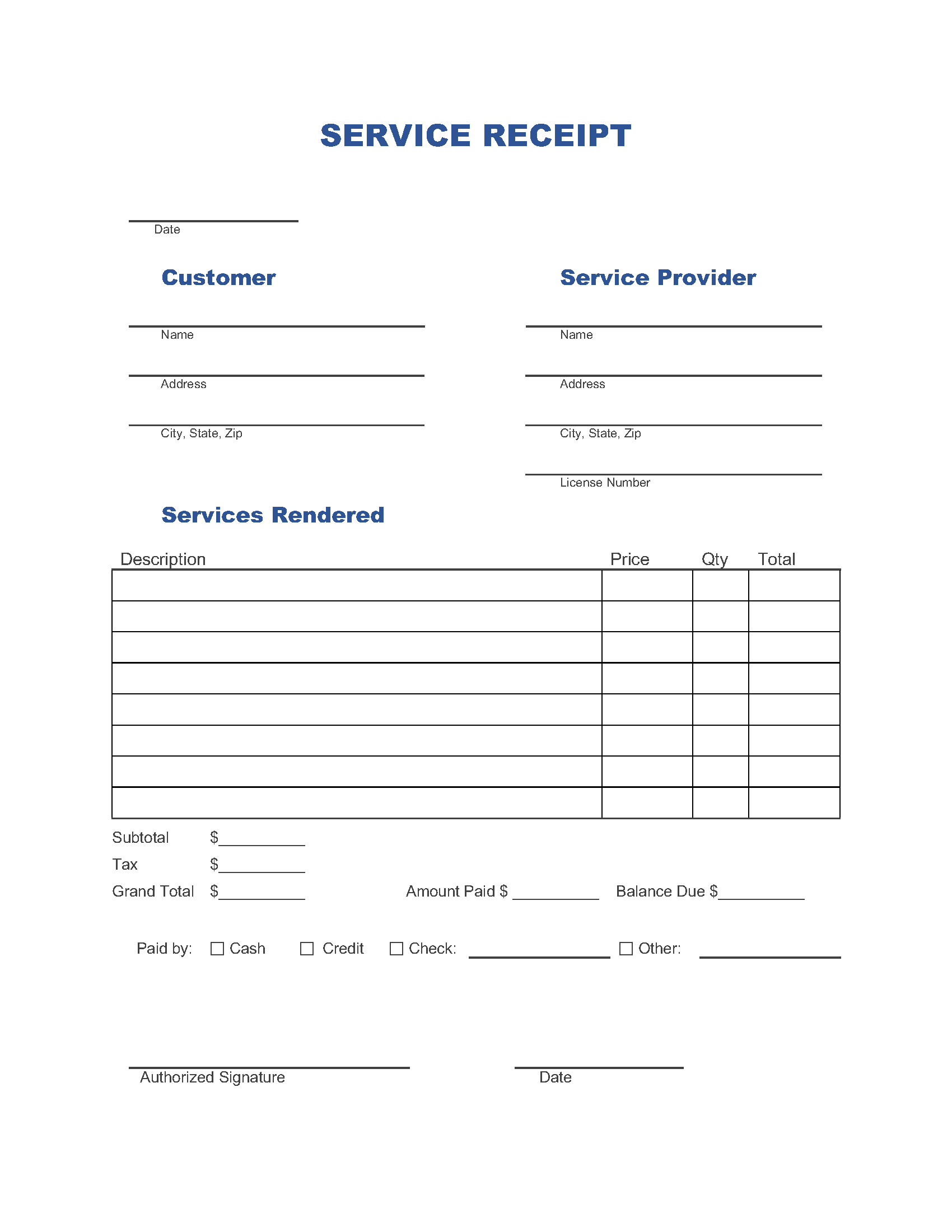

There are a couple of ways to issue service receipts. The first is with a cash register. This, of course, applies to in-person services. These receipts are “printed” on thermal paper with heat applied as the “ink.” The alternative is to use a template to create a more detailed itemized receipt, similar to an invoice. These receipts include detailed line items explaining the services provided and the breakdown of associated costs. Receiptmaker’s fillable service and downloadable templates are perfect examples of detailed receipt templates.

What to Include in a Service Receipt

The value of using a template is customization. The bolded items below are necessary to include in a service receipt, while the rest are optional suggestions depending on the content of the receipt and the nature of the services provided.

- Date(s) of service;

- Discounts;

- Itemized description of services provided and their associated costs;

- Payee’s name, address, phone number, and logo;

- Payment method (cash, check [number], credit card [number, expiration, security code], other);

- Payor’s name, address, and phone number;

- Receipt number;

- Sale amount;

- Shipping;

- Tax amount;

- Time(s) of service;

- Total amount due;

- Total amount received; and

- Transaction date.

Table: Are Services Taxable? (By State)

Whether services are subject to sales tax varies by state. The table below specifically applies to state sales taxes, not county or municipal sales taxes. COLUMNS: STATE / STATE TAXABLE SERVICES / STATE SALES TAX RATE

- Alabama – Select services – 4%

- Alaska – No services – No state sales tax

- Arizona – Transaction privilege tax applies to select services – 5.6%

- Arkansas – Select services – 6.5%

- California – All services directly exchanged with the taxable transfer of personal property – 7.25%

- Colorado – All services directly exchanged with the taxable transfer of personal property, Rooms and Accommodations – 2.9%

- Connecticut – Select services – 6.35%

- Delaware – Gross receipts tax on all services – No state sales tax

- Florida – Select services – 6%

- Georgia – Select services – 4%

- Hawaii – All services – 4%

- Idaho – Select services – 6%

- Illinois – All services directly exchanged with the taxable transfer of personal property – 6.25%

- Indiana – Select services – 7%

- Iowa – Select services – 6%

- Kansas – Select services – 6.5%

- Kentucky – All services directly exchanged with the taxable transfer of personal property, Select services – 6%

- Louisiana – Select services – 4.45%

- Maine – Select services – 5.5%

- Maryland – Select services – 6%

- Massachusetts – Telecommunications services – 6.25

- Michigan – Select services – 6%

- Minnesota – Select services – 6.875%

- Mississippi – Select services – 7%

- Missouri – Select services – 4.225%

- Montana – No services – No state sales tax

- Nebraska – Select services – 5.5%

- Nevada – All services directly exchanged with the taxable transfer of personal property – 6.85%

- New Hampshire – No services – No state sales tax

- New Jersey – Select services – 6.625%

- New Mexico – All services – 5.125

- New York – Select services – 4%

- North Carolina – Repair, Maintenance, and Installation Services – 4.75%

- North Dakota – Select services – 5%

- Ohio – Select services – 5.75%

- Oklahoma – Select services – 4.5%

- Oregon – No services – No state sales tax

- Pennsylvania – Select services (and some more) – 6%

- Rhode Island – Gas (utility), Hotel, Telecommunications and Cable TV – 7%

- South Carolina – Select services – 6%

- South Dakota – All services – 4.5%

- Tennessee – Select services – 7%

- Texas – Select services – 6.25%

- Utah – Select services – 6.1%

- Vermont – All services directly exchanged with the taxable transfer of personal property – 6%

- Virginia – All services directly exchanged with the taxable transfer of personal property, Hotel – 5.3%

- Washington – Select services – 6.5%

- Washington, D.C. – Select services – 6%

- West Virginia – All services (select exemptions) – 6%

- Wisconsin – Select services – 5%

- Wyoming – Select services, Lodging tax – 4%