It usually includes detailed information about every repair or service applied to a vehicle. The receipt also itemizes the individual costs of the repairs, services, and labor, providing the vehicle owner with detailed documentation of the vehicle’s service history. If the vehicle owner’s insurance company is involved with payment, the car service receipt will also include information about the owner’s policy. Alternatively, if the owner wants to submit a claim request to their insurance company after services are complete, they can ask to include their insurance policy information on the receipt.

It usually includes detailed information about every repair or service applied to a vehicle. The receipt also itemizes the individual costs of the repairs, services, and labor, providing the vehicle owner with detailed documentation of the vehicle’s service history. If the vehicle owner’s insurance company is involved with payment, the car service receipt will also include information about the owner’s policy. Alternatively, if the owner wants to submit a claim request to their insurance company after services are complete, they can ask to include their insurance policy information on the receipt.

Table of Contents

Who Uses a Car Service Receipt?

Any business or technician that provides vehicle-related services can use a car service receipt, including but not limited to the following:

- Auto parts stores (that provide minor services);

- Body shops;

- Customs shops;

- Dealership service centers;

- Interior shops;

- Mechanic/repair shops;

- Oil change shops;

- Paint shops;

- Refurbishment specialists;

- Tire centers; and

- Transmission repair shops.

Are Car Services Subject to Sales Tax?

Car services are subject to state sales taxes in the following states:

- Arkansas, Connecticut, Delaware (gross receipts tax), Florida, Hawaii, Iowa, Kansas, Louisiana, Mississippi, New Mexico, New York, North Carolina, Oklahoma, Pennsylvania, South Dakota, Utah, West Virginia, and Wyoming.

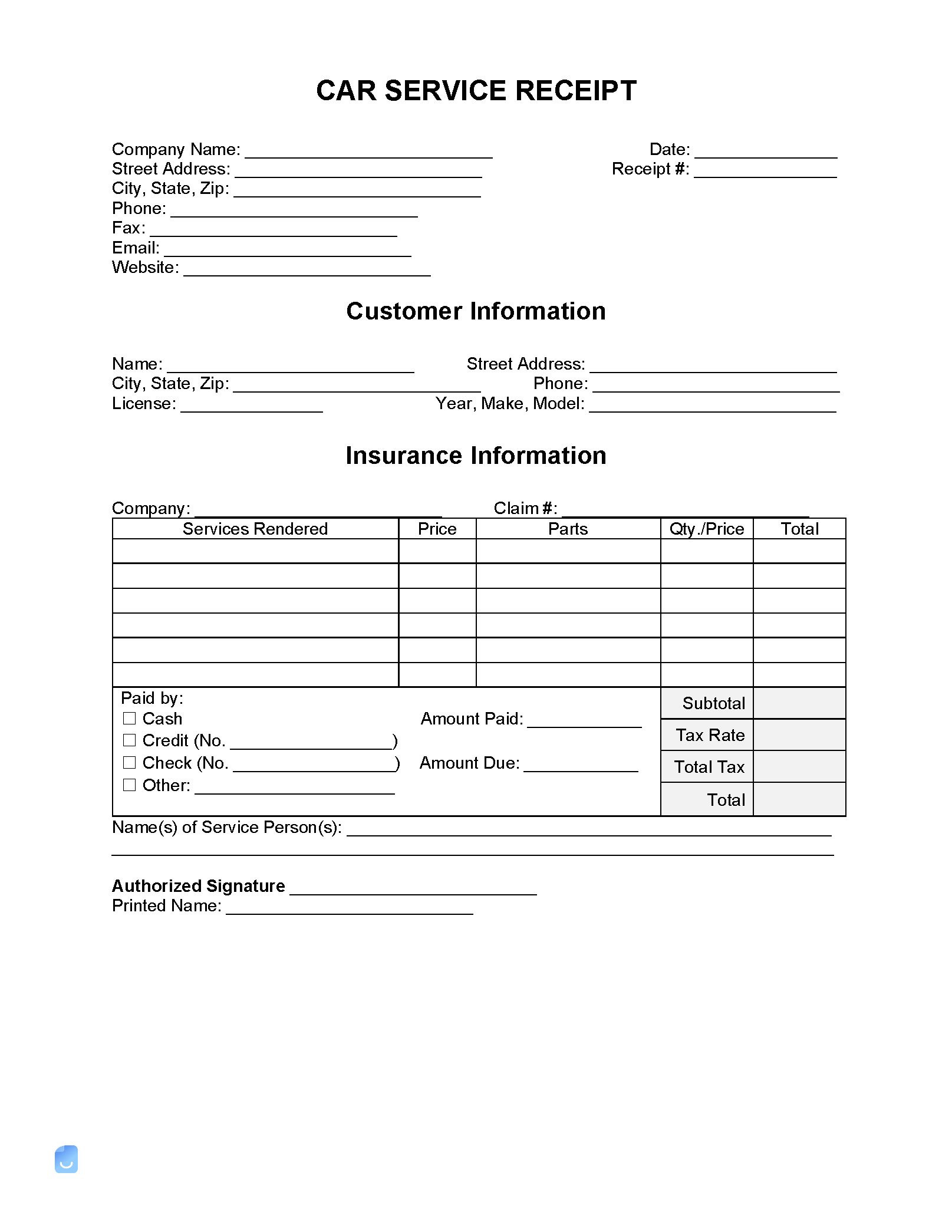

What to Include

- Customer’s insurance information, including provider name, customer policy number, and service claim number;

- Customer’s name, address, phone number, email address, driver’s license number, and signature;

- Itemized list of goods included with services and their associated quantities and costs;

- Itemized list of services provided with their associated schedules and costs;

- Payment method (cash, check, credit card, other);

- Receipt number;

- Service company’s name, address, phone number, email address, and website;

- Service provider/technician’s name, license number (if applicable), and signature;

- Subtotal;

- Tax rate (if applicable);

- Total tax due (if applicable);

- Total amount due;

- Total amount paid;

- Total balance due (if applicable);

- Transaction date; and

- Vehicle details, including the year, make, model, color, transmission (manual or automatic), engine type (gas, electric, or hybrid), and odometer reading.