Depending on the nature of the care facility and the frequency of services provided, providers can issue receipts upon payment, weekly, monthly, or quarterly. Childcare receipts are essential financial records for providers and proof of payment for guardians.

Depending on the nature of the care facility and the frequency of services provided, providers can issue receipts upon payment, weekly, monthly, or quarterly. Childcare receipts are essential financial records for providers and proof of payment for guardians.

Table of Contents

Who Uses a Childcare Receipt?

Any business or contractor that provides childcare services in-home or in a facility can utilize a Childcare Receipt. These include but are not limited to the following:

- After-school care programs;

- Daycares;

- Full-time nannies;

- Medical facilities;

- Office/employer childcare programs; and

- Pre-schools.

Are Childcare Services Subject to Sales Taxes?

When a childcare provider is a private business (like a daycare), a part-time independent contractor, or a one-time freelance care provider, services are subject to sales taxes in the following states:

The Nanny Tax

Different rules apply to in-home childcare providers. The nanny tax is a group of state and federal taxes addressing household employees, including in-home childcare providers. For the employee, they include income taxes, Medicare taxes, and Social Security taxes (the latter two are referred to as FICA taxes). Employees are responsible for paying these taxes whether or not their employer withholds them from paychecks. Employers are responsible for paying FICA taxes and unemployment insurance. Employers and employees are required to pay nanny taxes when the employee earns more than the annual minimum established by the IRS from that specific employer ($2,400/year or $1,000/quarter for 2022). If the employee earns less than the minimum, the employer can treat them as an independent contractor. Employers who don’t file for their childcare providers properly can be guilty of tax evasion.

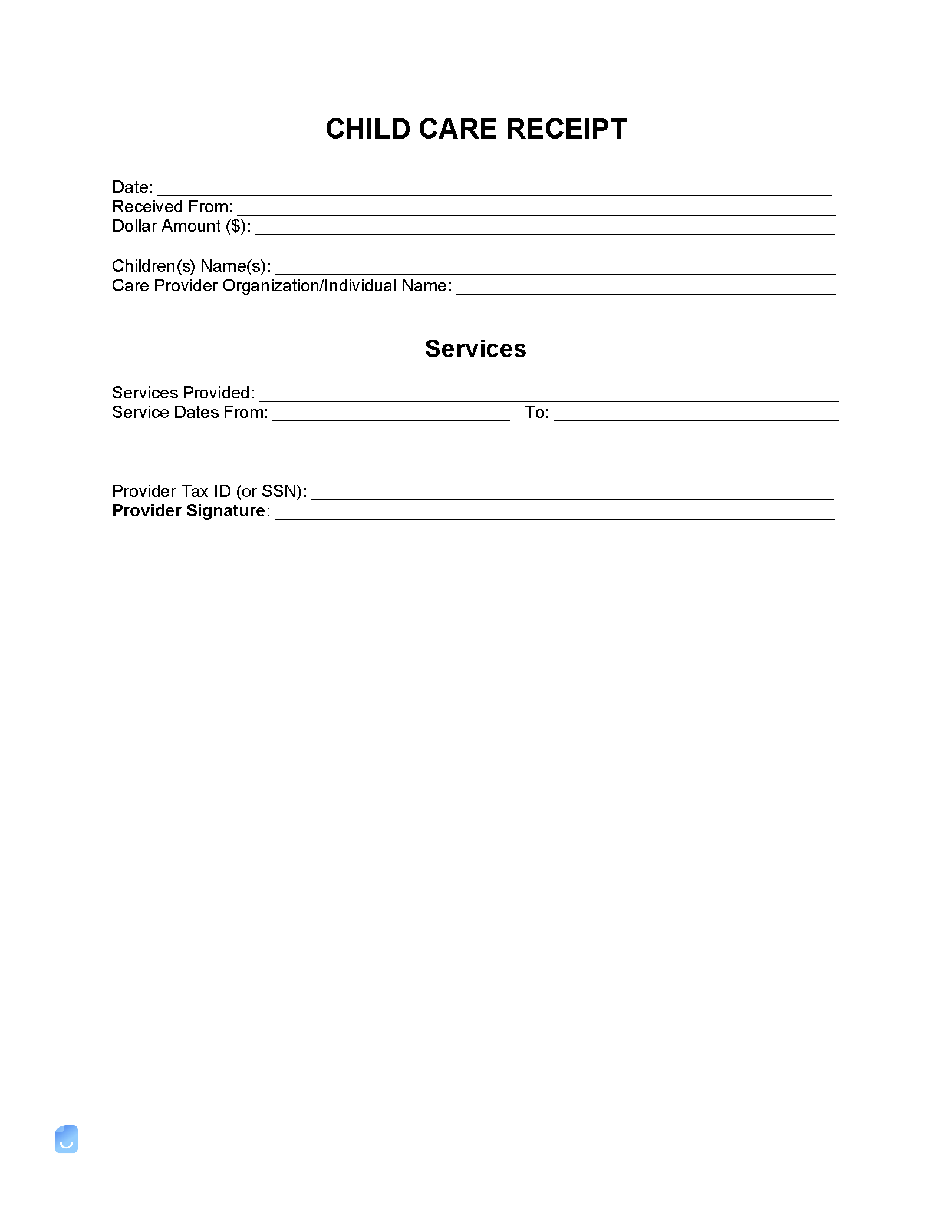

What to Include

- Care provider name, address, phone number, and website (if applicable);

- Child’s name;

- Dates of service;

- Description of services provided;

- Hourly rate;

- Parent/guardian name, address, phone number;

- Number of hours worked;

- Total amount due;

- Total amount paid;

- Total balance due; and

- Transaction date.