It includes details about the seller, transaction, and purchased goods or services. Cash receipts are significant because, unlike credit card or check purchases, they are the only evidence that a transaction occurred. They are crucial for bookkeeping purposes and tax-deductible purchases.

It includes details about the seller, transaction, and purchased goods or services. Cash receipts are significant because, unlike credit card or check purchases, they are the only evidence that a transaction occurred. They are crucial for bookkeeping purposes and tax-deductible purchases.

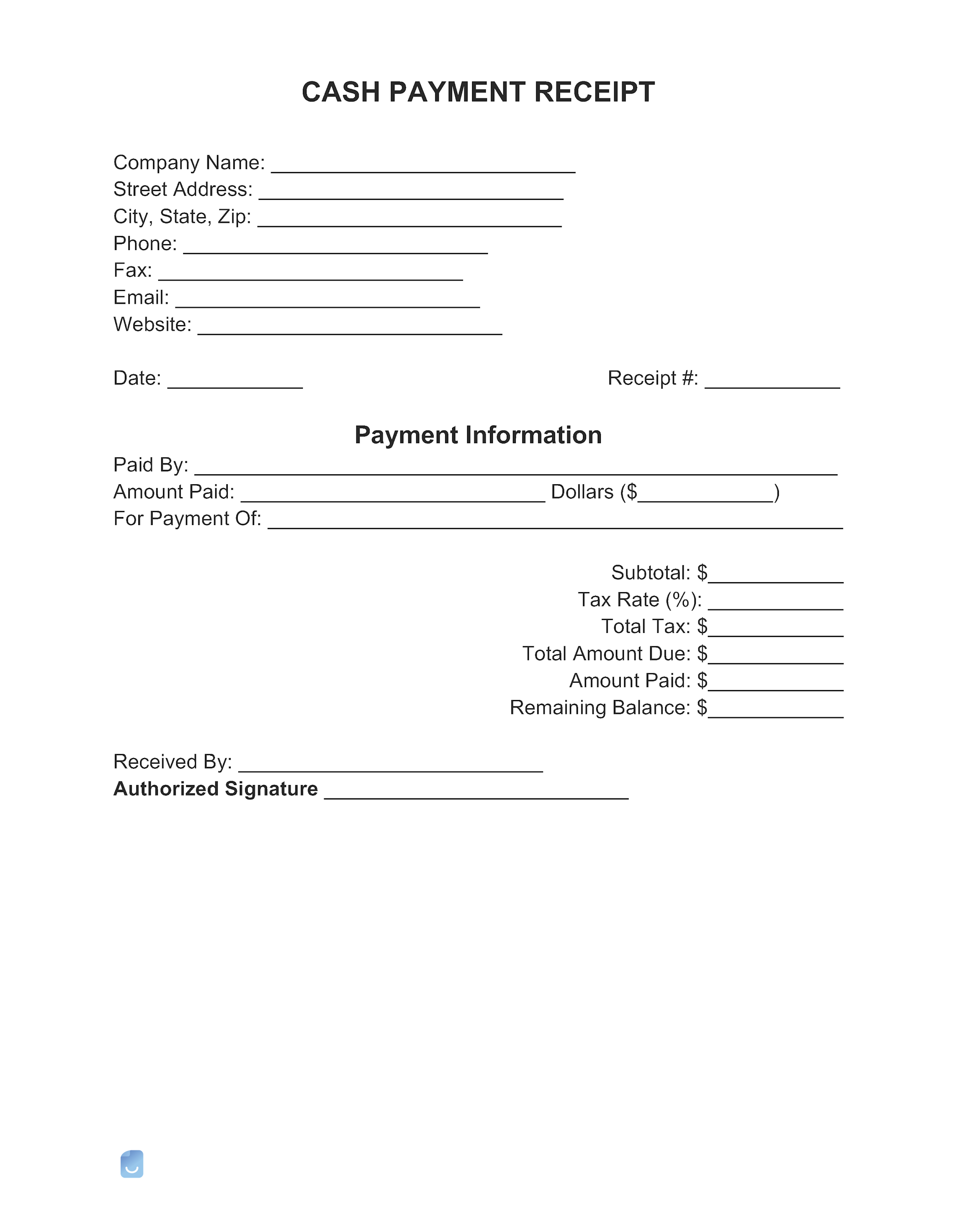

What to Include

- Buyer information (name, address, phone, email);

- Item description (make, model, year, color, condition, additions);

- Payment method (cash, check, credit card, other);

- Receipt number;

- Received by (seller representative’s name and title/position);

- Seller information (name, address, phone, email);

- Signatures of both parties;

- Summary of charges:

- Cost of item(s),

- Cost of add-ons (if applicable),

- Quantities of items and add-ons,

- Subtotal,

- Tax rate,

- Total taxes due,

- Total amount due,

- Amount paid, and

- Outstanding balance (if applicable); and

- Transaction date.