It serves as proof of the deposit amount, when the buyer (or renter) paid it, and who paid it to whom. The receipt is vital for both the payer and payee to keep a record of in case they have any misunderstandings or disputes regarding the transaction.

It serves as proof of the deposit amount, when the buyer (or renter) paid it, and who paid it to whom. The receipt is vital for both the payer and payee to keep a record of in case they have any misunderstandings or disputes regarding the transaction.

By Type (10)

- Boat Deposit Receipt

- Car Deposit Receipt

- Cash Deposit Receipt

- Damage Deposit Receipt

- Earnest Money Deposit Receipt

- Pet Deposit Receipt

- Puppy Deposit Receipt

- Rental Deposit Receipt

- Security Deposit Receipt

- Security Deposit Return Receipt

Table of Contents

What is a Deposit?

Deposits are generally known as one of two things: the act of putting money into an account managed by a financial institution for safekeeping or an actual sum of money transferred from one party to another to secure a good or service. When a deposit is paid for leasing purposes, the deposit confirms both entities are aware of the condition of the good or service in advance. The deposit represents the lessee’s agreement to return the goods in the same condition they were received or to provide a work environment suitable enough for the lessor to correctly and safely render the desired service. When a deposit is paid to hold an item for sale, it guarantees that another person can’t buy the good or service for the term agreed between the holder and seller.

Common Types of Deposits

There are two main types of deposits: demand deposits and term deposits. A demand deposit is any kind of “safe-keeping deposit” that can be retrieved in any amount at any time. In essence, the monetary value is available “on-demand.” There are no financial penalties for withdrawing a demand deposit. The most common demand deposit accounts are traditional checking and savings accounts. These accounts can pay interest on the held funds but aren’t required to include interest growth. A perfect example of a demand deposit withdrawal is a DDA or a Direct Debit Authorization. This automated authorization allows debit card purchases to withdraw funds without card owners having to approve individual transactions with their banks. A term deposit is usually made to a financial institution and the depositor can’t touch it for a designated amount of time. Accounts that hold term deposits almost always earn interest at higher rates than those containing demand deposits. These accounts also typically charge penalties when the account holder needs to withdraw funds before the maturity date (end of term) and require the account holder to provide advance notice before accessing the funds. Terms can vary anywhere from 30 days to five years, on average. The most common type of term deposit is called a certificate of deposit. It is a savings account that the owner agrees not to access for the specified term. These are often used to hold security deposits and other deposits related to rental properties.

When Should a Deposit Be Returned?

Whether or not a deposit is refundable depends on the agreement negotiated between the buyer (or renter) and seller. Term deposits are usually refundable after the renter returns the goods in the same or better condition than when they received them, or as long as a seller receives a safe and healthy work environment to provide their service. When a deposit is paid as a down payment on a purchase, it is non-refundable because it goes towards the total purchase price of the item.

Is a Deposit Receipt Required?

Whether a receipt is required depends on the type of deposit. Private entities and individuals may issue them to customers as an internal requirement for budget tracking. The following states require landlords to provide rent deposit receipts: Florida, Maryland, Massachusetts, Nevada, New York, Oregon, and Washington.

Should I Get a Receipt for a Deposit?

It is always advisable to request a receipt when paying a deposit for anything. If there are discrepancies regarding the transaction in the future, a deposit receipt can help clear up confusion.

Requirements

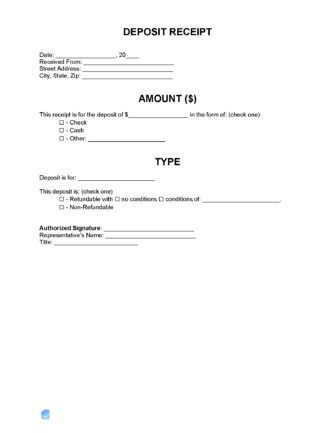

The following information should be included in a deposit receipt. Please note – this list is not exhaustive – different types of deposit receipts will also have different specifics in addition to the items on this list. Always include the:

- Deposit amount;

- Deposit description (what the deposit is for);

- Payee information (full name, address, phone number);

- Payer information (full name, address, phone number);

- Payment date;

- Payment method;

- Payment time;

- Refund terms;

- Remaining balance (if applicable);

- Remaining balance due date (if applicable);

- Signature lines for the payee and payer; and

- Third-party account-holder information (where the deposit is being held).