It confirms receipt, preserves donor records, maintains positive donor relations, and serves as the donor’s proof of the donation for IRS tax deductions. A donation receipt can be a letter, physical receipt, postcard, or thank you note. Donations can come from many places, including but not limited to auctions, competitions, contests, direct mail campaigns, DIY campaigns, email campaigns, galas, social media campaigns, and team campaigns.

It confirms receipt, preserves donor records, maintains positive donor relations, and serves as the donor’s proof of the donation for IRS tax deductions. A donation receipt can be a letter, physical receipt, postcard, or thank you note. Donations can come from many places, including but not limited to auctions, competitions, contests, direct mail campaigns, DIY campaigns, email campaigns, galas, social media campaigns, and team campaigns.

Donation Receipts: By Type (10)

- Cash Donation Receipt

- Church Donation Receipt

- Clothing Donation Receipt

- Food Donation Receipt

- In-Kind Donation Receipt

- Payroll Deduction Donation Receipt

- Political Donation Receipt

- Stock Donation Receipt

- Unreimbursed Donation Receipt

- Vehicle Donation Receipt

Table of Contents

- Donation Receipts: By Type (10)

- When are Donations Tax Deductible?

- Are Donation Receipts Required?

- What Information Goes in a Donation Receipt?

- IRS Resources

When are Donations Tax Deductible?

Only 501(c)(3) tax-exempt organizations that were formed in the U.S. are eligible to receive tax-deductible donations. The three 501(c)(3) categories are charitable organizations, churches and religious organizations, and private foundations. Other types of non-profits that don’t fall under the 501(c)(3) category can claim tax exemptions on a case-by-case basis.

Itemizing Deductions

Claiming charitable donations only reduces a tax bill if the taxpayer itemizes all of their deductions (medical expenses, mortgage interest, state and local taxes, etc.). It’s only wise to itemize deductions when the total anticipated deduction exceeds the tax year’s standard deduction. For reference, the standard IRS deductions for 2022 are:

- Single: $12,950

- Married (and filing jointly): $25,900

- Head of Household: $19,400

Deduction Limits

The IRS does set maximum deductions each tax year. Usually, taxpayers can deduct up to sixty percent (60%) of their adjusted gross income. The IRS can limit this percentage to 20%, 30%, or 50%, depending on the types of donations and their recipients. Some specific exceptions come with lower limits, such as:

- Certain private foundations;

- Fraternal societies;

- Nonprofit cemeteries; and

- Veterans organizations.

Tax Loss Carryover

When a taxpayer’s annual charitable contributions exceed the deduction limits for a specific tax year, some contributions can “carry over” to subsequent tax years for up to five (5) years after the original filing.

Are Donation Receipts Required?

Donation receipts are vital for donors. When a charitable organization is tax-exempt, a donor can claim a deduction on their tax return for the year the donation was made. The IRS requires donors to have a donation receipt on file to make this type of claim. It is up to the donor to request a receipt if they don’t automatically receive one for a donation. Charitable organizations are only legally required to provide donation receipts when:

- The donation is more than $250; or

- The organization provides goods or services in exchange for donations of more than $75 (quid pro quo).

If the organization fails to provide a receipt in either of these cases, it will pay a fine of $10 per contribution violation and a maximum of $5,000 per fundraising campaign or event. For donations of less than $250, the IRS only requires a bank record or a written statement from the charitable organization that includes the name of the charity, the donation date, and the donation amount. This requirement falls solely on the donor, so it is their responsibility to obtain one from the appropriate charity. When a donor attempts to claim contributions over $5,000 in value, the IRS will require an official appraisal by a qualified appraiser before approving the deduction.

When to Send a Donation Receipt

Charities have some flexibility when sending donation receipts. They can either send individual receipts each time a donation is received or compile an annual donation receipt itemizing every donation made by a donor in a calendar year. In either case, it is wise for organizations to send all receipts to donors no later than January 31st for the previous year’s taxes. This is generally when employment tax forms are due to employees, so many people begin filing their taxes in February.

How Long to Keep a Donation Receipt

General best practices for document retention advise that all types of organizations retain files for at least seven (7) years. Concerning the IRS, tax-exempt organizations must keep records for at least five (5) years to keep actual data for its periodic public support tests.

What Information Goes in a Donation Receipt?

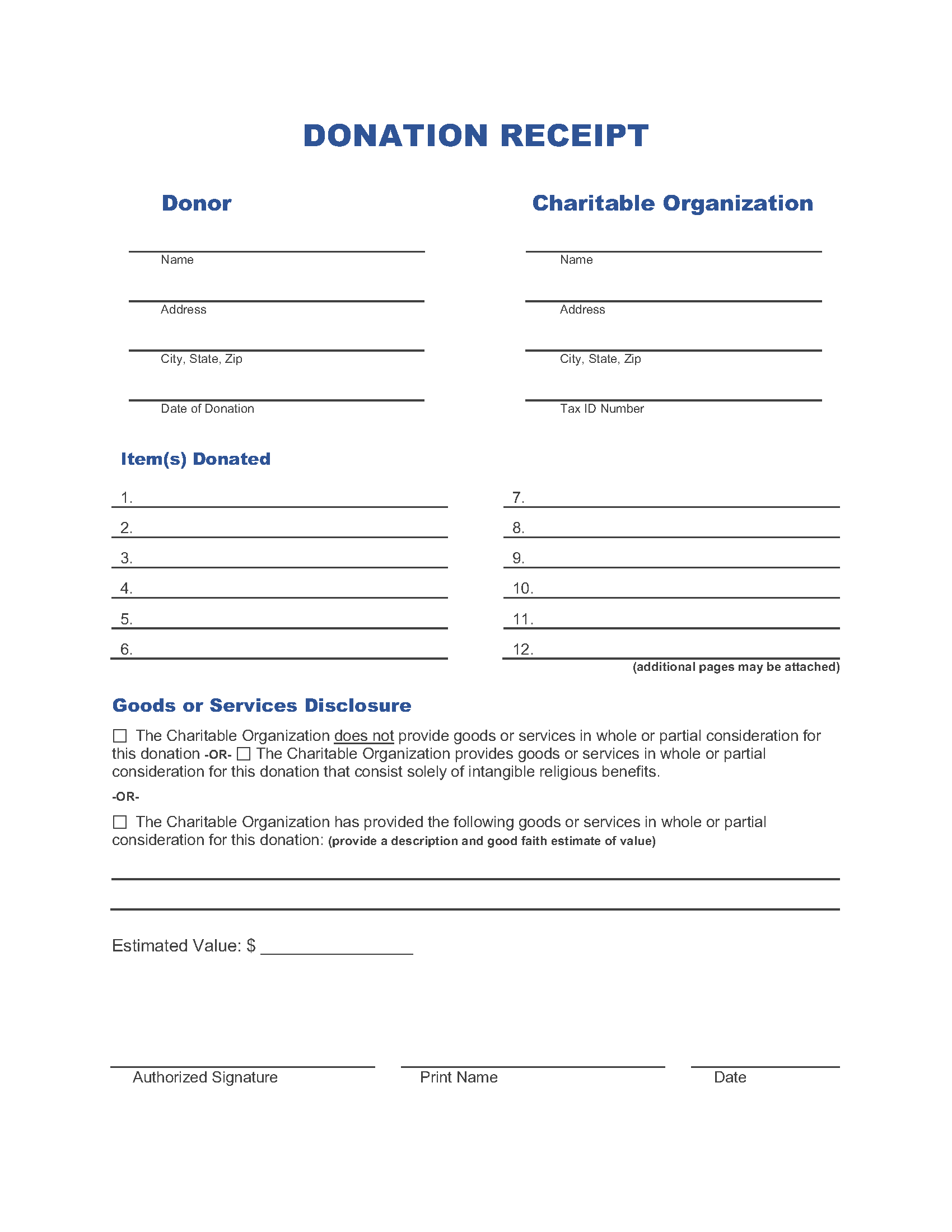

The IRS has specific requirements regarding the information included in donation receipts. It will deny deduction claims when receipts lack the necessary details, which can be bad for donor relations. Donation receipts must include the following items:

- Names of the charitable organization and the donor;

- Date the donation was received by the charitable organization;

- A detailed description of the donation:

- Cash: Exact breakdown of bills;

- Credit card: Full name on the card, last four digits of the card number, and card expiration date;

- Personal check: Donor name, donor address, bank name, account number, and check number;

- Property: Physical description of the item donated;

- Stock: Company name and number of donated shares.

- The exact amount of a monetary or financial donation (never include the value of physical donated property);

- A clear statement claiming whether or not the organization provided goods or services to the donor in exchange for their donation (quid pro quo);

- The value of the goods or services provided by the charity and a clear statement expressing how the valuation affects the potential tax deduction (if goods and services were exchanged for the donation).

Aside from these IRS requirements, it’s also wise to include more details about the charitable organization, including its address, phone number, EIN (tax identification number), and the name and signature of an authorized representative of the organization. Adding marketing content to donation receipts is a great way to encourage repeat donations in the future. Depending on the format of the receipt, charities can include relevant blogs, photos, testimonials, and videos that promote their causes.

Quid Pro Quo Exceptions

When a charitable organization provides goods or services in exchange for a donation, the amount of the donor’s available deduction generally gets reduced by the fair market value of the goods or services provided by the organization. There are only three exceptions to this rule: Token Exception: Insubstantial goods or services don’t have to be itemized in a donation receipt. If an organization gifts a branded item or a service worth $11.70 or less in exchange for a donation of $58.50 or more, the item or service is considered insubstantial. Membership Benefits Exception: When a membership fee is received as a donation, only insubstantial goods or services must be itemized in a donation receipt. This exception only applies when the membership fee is $75 or less. Services that can be provided to members but don’t have to be itemized on a receipt include gift shop discounts and free or discounted admissions to facilities, events, and parking. Intangible Religious Benefits Exception: Tax-exempt religious organizations are allowed to include a simple statement that “intangible religious benefits” were exchanged with the donor for their donation. Examples of benefits include admission to religious ceremonies and “de minimis” (trivial) goods and services (for example, when small servings of the “host” and wine are given to attendees in Catholic masses).