The receipt notes the donation’s amount or description, the donation date, and contact information for the donor and BBBS. Depending on the type of donation, donors can use the receipt to claim a deduction on their IRS tax returns.

The receipt notes the donation’s amount or description, the donation date, and contact information for the donor and BBBS. Depending on the type of donation, donors can use the receipt to claim a deduction on their IRS tax returns.

Table of Contents

- What is Big Brothers Big Sisters of America?

- How to Donate (3 Steps)

- Where Does the Money Go?

- Big Brothers Big Sisters of America Resources

What is Big Brothers Big Sisters of America?

Big Brothers Big Sisters of America is a 501(c)(3) nonprofit organization that provides one-on-one mentoring relationships to support its participants’ emotional, mental, and physical health and well-being. The organization serves children as young as five (5) years old and through adulthood. It boasts more than 230 agencies across all fifty (50) states and is present in twelve (12) countries. Over 400,000 families and mentors currently participate in the program. The roots of BBBS began in 1904 in New York City. Court clerk Ernest Coulter started the Big Brothers Movement, inspired by an increasing number of boys appearing in court. He recruited local volunteers to mentor struggling boys and young men. At about the same time, the Ladies of Charity were taking young women under their wings who were coming out of the New York Children’s Court system. This group would ultimately become the Catholic Big Sisters. In 1977, Big Brothers Association and Big Sisters International merged to create Big Brothers Big Sisters of America. Forbes listed Big Brothers Big Sisters in the Top Ten (10) charities in the United States for 2021. Children with role models are likelier to improve in school and their relationships with family and friends. They are less likely to

- Abuse drugs;

- Commit crimes;

- Consume alcohol underage; and

- Skip or drop out of school.

How to Donate (3 Steps)

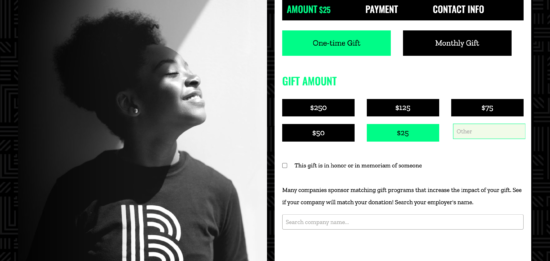

Step 1: Amount

Visit this page to donate online to Big Brothers Brothers Big Sisters of America. Select the donation type (one-time or monthly) and the gift amount. Also, note if the gift is in honor of another person. If the donor’s employer matches charitable contributions, the donor can search for the company on this page to attach it to the donation.

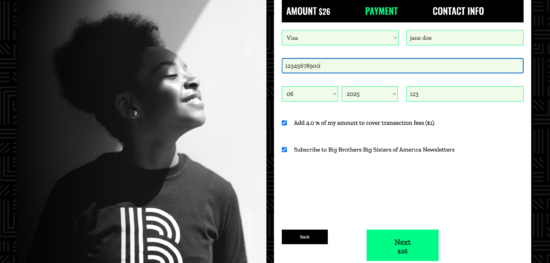

Step 2: Payment

Enter the donor’s credit card information and note if the donor wants to add 4% of the contribution to cover transaction fees for BBBS. The donor can also subscribe to the BBBSA newsletter.

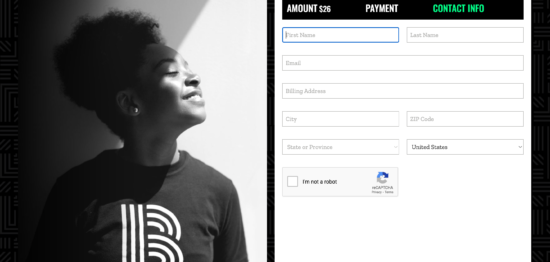

Step 3: Contact Information

Enter the donor’s name, email, and billing address before completing the donation. The BBBS follows up with a donation receipt to the email address provided in this step.

Become a Big

Bigs provide one-on-one mentoring friendships with Littles. They usually spend time together two or three times per month. Each visit lasts a few hours. They can participate in everyday activities that promote education, emotional health, friendship, and physical activity. Examples include but are not limited to:

- Eating meals together;

- Going to parks;

- Homework help;

- Live music;

- Local BBBS events;

- Movies;

- Museums;

- Playing games (board, card, video);

A Match Support Specialist pairs Bigs and Littles through the Big Brothers Big Sisters Match program. The process is safe and catered to the child’s specific needs. Both Big and Little receive resources for continuous learning and support through technology and partnerships.

Other Ways to Donate

- Cars for Kids’ Sake

- Donor Advised Fund

- IRA Charitable Rollover

- Matching Gifts

- Personal Check

- Stocks and Securities

Cars for Kids’ Sake Vehicle donations to BBBS are tax deductible. The organization can accept airplanes, boats, cars, construction equipment, farm equipment, motor homes, motorcycles, SUVs, and trucks. How to Donate:

- Call the BBBS Vehicle Donation Program at 1-800-710-9145; or

- Submit the information online to connect with a vehicle donation expert.

Donor Advised Fund Contributing through a Donor Advised Fund is beneficial for several reasons. The process is easily accessible, flexible, and simple to arrange with the account manager. DAF donations are tax-deductible, and they provide investment options. The donor can also submit the contribution anonymously. IRA Charitable Rollover There are some requirements for a donor to be eligible to contribute via an IRA charitable rollover:

- The donor must be at least 70 ½ years old;

- The donor’s total charitable contributions for the year can’t exceed $100,000;

- The gift can’t go to a Donor Advised Fund, supporting organization, or private foundation;

- The gift must come directly from an IRA (not a 401(k), 403(b), or 457 plan);

- The recipient can’t exchange material benefits or goods for the contribution;

It’s important to note that this type of donation is not tax-deductible because it’s not included in the donor’s taxable income. How to Donate:

- Instruct the IRA administrator to transfer the funds to the designated charity.

- Contact BBBS at 1-813-720-8778 for instructions on completing the gift and obtaining a donation receipt.

Matching Gifts Sometimes employers will match donations made by their employees. Check here to find out if an employer matches contributions to BBBS. Personal Check Donations made by personal check are considered cash donations and therefore are tax-deductible. How to Donate:

- Download, print, and complete the BBBS donation form.

- Mail the form and check to:

Big Brothers Big Sisters of America Attention: Individual Giving 2502 N. Rocky Point Dr. Ste. 550 Tampa, FL 33607

Stocks and Securities BBBS can accept donations of bonds, mutual funds, stocks, and other appreciated securities. The donor can deduct the total fair market value of securities they’ve held for more than one (1) calendar year. They can often avoid paying capital gains taxes on donated securities as well. How to Donate: When a bank or brokerage firm holds the securities:

-

- Send a letter to the bank or firm with the full description of the donated securities, the details of the donation recipient, and the gift’s intended purpose.

- The broker or banker can send the gift electronically to:

Morgan Stanley Big Brothers Big Sisters of America Account #574711913 DTC #0015

When the securities are held directly by the donor:

- Contact the Fund Development Team at 1-813-605-7428 to alert them of the gift.

- Send the unsigned certificates, notarized stock power of attorney, and a letter confirming the contribution by certified mail to:

Big Brothers Big Sisters of America Attention: Individual Giving 2502 N. Rocky Point Dr. Ste. 550 Tampa, FL 33607

Where Does the Money Go?

BBBS facilitates three programs to help families and Bigs get involved. Each program targets the needs of a particular community. The Amachi Program focuses on children with incarcerated parents. Religiously affiliated role models are popular in this program. Operation Bigs provides Bigs for children in military families. Bigs are often active military or veterans. School-Based Mentoring allows Bigs and Littles to meet at the Little’s school during the week. They can spend time in the classroom, library, gym, playground, or other facilities the school campus offers. Bigs and Littles aren’t required to do academic activities, but this program benefits Littles who are struggling academically.