It accepts donations in many forms, but donors’ tax implications depend on whether they make donations directly to the Union or the ACLU Foundation. The Union automatically provides donation receipts, whether or not a contribution is tax deductible.

It accepts donations in many forms, but donors’ tax implications depend on whether they make donations directly to the Union or the ACLU Foundation. The Union automatically provides donation receipts, whether or not a contribution is tax deductible.

Table of Contents

What is the ACLU?

The ACLU, or American Civil Liberties Union, is a non-profit, non-partisan public interest law firm. Its mission is to defend individual civil liberties in the United States. It boasts about 1.7 million members, a handful of staff lawyers, and over two thousand (2,000) volunteer lawyers. The ACLU also hosts a network of affiliate law offices in all fifty (50) states. The the American Civil Liberties Union appears before the Supreme Court of the United States more frequently than any other entity besides Department of Justice. The ACLU addresses all of the following issues:

- Capital punishment;

- Criminal law reform;

- Disability rights;

- Due process;

- Free speech;

- HIV/AIDS;

- Human rights;

- Immigrants’ rights;

- Juvenile justice;

- LGBTQ+ rights;

- National security;

- Prisoners’ rights;

- Privacy and technology;

- Racial justice;

- Religious liberty;

- Reproductive freedom;

- Smart justice;

- Voting rights;

- Women’s rights; and

- Workplace rights.

Donation Information

Where Does the Money Go?

The ACLU is funded through donations, grants from private foundations, and member dues (no government funding). It directs all of its funding into a three-pronged approach to civil rights advocacy: education, litigation, and lobbying.

Are Donations to the ACLU Tax Deductible?

There are two branches of the ACLU: the American Civil Liberties Union and the ACLU Foundation. Donations to the Union are not tax deductible, but donations to the Foundation are. American Civil Liberties Union The American Civil Liberties Union is a 501(c)(4) non-profit organization. The two types of organizations that fall under the 501(c)(4) category are social welfare programs and local associations of employees (or unions). Donations made to 501(c)(4) organizations are not tax deductible. The ACLU is a membership organization, so its donations only come from membership dues. These dues fund the ACLU’s legislative lobbying efforts, a strict violation of the qualifications for a 501(c)(3) charity. ACLU Foundation For this reason, the Union created the ACLU Foundation. The Foundation is a qualified 501(c)(3) charity because its donations only fund litigation and public education. Any donation made to the ACLU Foundation is tax deductible with a proper ACLU Foundation donation receipt.

Are Donations Refundable?

The organization only issues a refund if a donation is made in error. In this instance, a donor must request a refund within fifteen (15) days of the donation date.

How Long to Keep the Receipt

The IRS recommends maintaining all tax-related files for at least three (3) years after their respective filing dates. It is safest to keep all files for at least seven (7) years because when the IRS identifies a significant error in an audit, they generally don’t dig further back than six (6) years in the subject’s tax returns.

How to Donate (5 Steps)

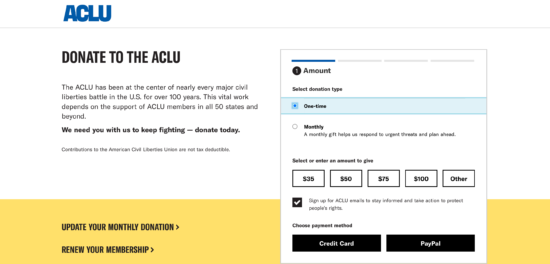

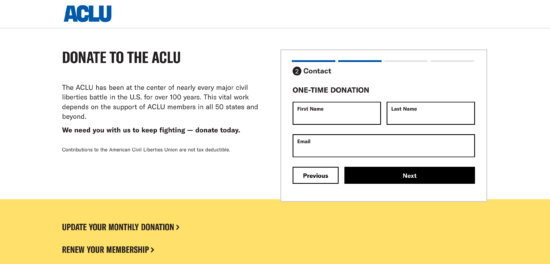

The simplest way to donate to the ACLU is through its online donation portal. Anyone can do this in five (5) simple steps: Step 1: Visit the ACLU’s online donation portal. Select a donation type (one-time or monthly), donation amount (listed or custom), and payment type (credit card or PayPal). For this example, we’ve selected a one-time donation of $5.00 with a credit card.  Step 2: Selecting the payment type leads to the Contact page. Enter the donor’s first name, last name, and email address, then click “Next.”

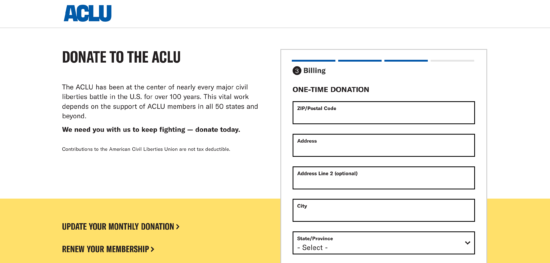

Step 2: Selecting the payment type leads to the Contact page. Enter the donor’s first name, last name, and email address, then click “Next.”  Step 3: On the Billing page, enter the billing address associated with the donor’s credit card. Then click “Next.”

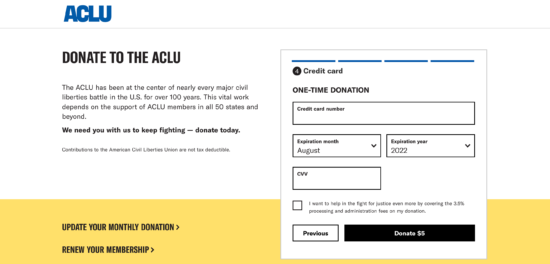

Step 3: On the Billing page, enter the billing address associated with the donor’s credit card. Then click “Next.”  Step 4: This will take you to the Credit Card page. Enter the donor’s credit card information and click “Donate $5.00” to complete the transaction. Please note: that the actual donation amount will reflect in the “Donate” button. Use this to reconfirm the total donation amount before finalizing the transaction.

Step 4: This will take you to the Credit Card page. Enter the donor’s credit card information and click “Donate $5.00” to complete the transaction. Please note: that the actual donation amount will reflect in the “Donate” button. Use this to reconfirm the total donation amount before finalizing the transaction.  Step 5: Wait to receive the ACLU donation receipt by email.

Step 5: Wait to receive the ACLU donation receipt by email.

Other Ways to Donate

Check: Mail physical checks to ACLU Development, 9450 SW Gemini Dr, PMB 62825, Beaverton, Oregon 97008-7105 Charitable Gift Annuities: The ACLU’s charitable gift annuity program provides secure, fixed payments for life for the donor or a beneficiary of their choice. Rates are as high as 9.1% and will never change once established. Complete this form to enroll. Corporate Giving: Corporate donations occur on a case-by-case basis. Complete this form to connect with an ACLU representative. Donor Advised Funds: Make a grant recommendation for the ACLU Foundation using the following mailing address: American Civil Liberties Union Foundation, Inc., 125 Broad Street, 18th Floor, New York, NY 10004. Gift Planning: Confirm the ACLU as a beneficiary of a will, trust, or financial policy. It can be an actual dollar amount, a life insurance policy, a percentage of the estate, the remaining balance of a financial account, or retirement assets. Impact Society: This society comprises all donors that contribute more than $1,000 to the ACLU Foundation annually. It has three subcategories that come with varying membership “perks”: Freedom Circle ($1,000 annually), Justice Circle ($5,000 annually), and Leadership Circle ($10,000 annually). Matching Gifts: Search to find out if an employer matches employee donations to the ACLU. Stocks and Securities: Send the name of the stock, number of shares, and donor’s name and address to stock@aclu.org. ACLU Foundation (tax-deductible): DTC #: 0226 Account Name: ACLU Foundation Account #: AB2-027707 Brokerage: State Street Global Markets, Boston, MA American Civil Liberties Union (not tax-deductible): DTC #: 0226 Account Name: AMERICAN CIVIL LIBERTIES UNION INC Account #: AB2-037225 Brokerage: State Street Global Markets, Boston MA Wire Transfer: Email leadership@aclu.org or call 212.284.7381.